Building a scalable end-to-end lead generation system integrating analytics and social media.

As the project was complex, teams at both at Bankrate and Perennial worked closely and seamlessly to create a robust solution.

1. We deployed an end-to-end, dedicated engineering team comprising analysts, technical managers, developers and QA. The team ensured an overlap of time zone and built self-service automated tools for the marketing team, wherever possible.

2. We developed a single customizable framework for all the insurance verticals, to adjust to the dynamic customer behaviour feedback we received through analytics and from the business team. This framework allowed a dynamic configuration of the site and reduced the engineering effort drastically – from weeks to mere hours.

3. Our team also developed a strong analytical framework to provide feedback to measure user behaviours and segments through coherent analytics.

4. We included A/B testing and optimization to ensure a continuous improvement in user experience.

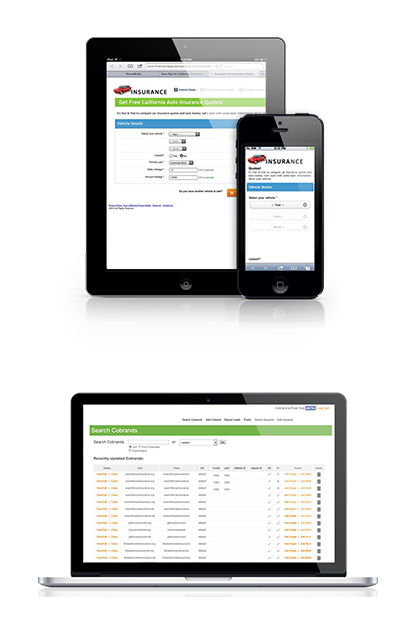

5. We built easy-to-use, customizable user interfaces to make sure there was a seamless user experience for the leads from the affiliates.

6. We developed a lead management system to allow quick affiliate enrollments as well as an auto-initiated affiliate setup wizard to setup an affiliate branded site. This reduced the affiliate enrolment effort from several days to just a few hours.

7. We set up a lead validation engine that integrates various 3rd party platforms, validating leads using mobile, SMS, social media and other means to intelligently detect genuine leads.

8. We even built a lead submission engine that is intelligently integrated to different insurance backend systems. These systems have configurable algorithms for getting the maximum ROI for a lead. The engine also manages unsold leads by further data verification and validation to sell legitimate leads.

9. We tuned and tested the system architecture to support millions of users.

Technology Stack:

Apache HTTP, Apache Tomcat, Struts 2.0, J2EE, Hibernate, MySQL